You are inside a mind. Take a minute to get accustomed to the light; it’s a bit dim. Now, what’s the reason you’re here? You’ve come because you’re appalled, and a little curious.

Over the last several years you’ve been inundated with news of scandals, one disgraceful episode after another – Enron, sponsorship, WorldCom, Hollinger, Abu Ghraib, Nortel, to name only a few. One name is all it takes to conjure up a complete story or image – our scandals are like our celebrities in that way. But these images are dark; the stories are disturbing narratives of misconduct, greed and corruption, of fortunes stolen and lives ruined. And though, together, they tell you something must be terribly wrong, with our society, or with ourselves, they don’t tell you what. They don’t tell you why this is happening. Why Enron officials would overstate their company’s profit by more than half a billion dollars (US). Why American soldiers would abuse their captives in an Iraqi prison. Why WorldCom executives would inflate company profits by more than $11 billion (US), or why Conrad Black would allegedly spend $24,950 of Hollinger’s money on summer drinks.

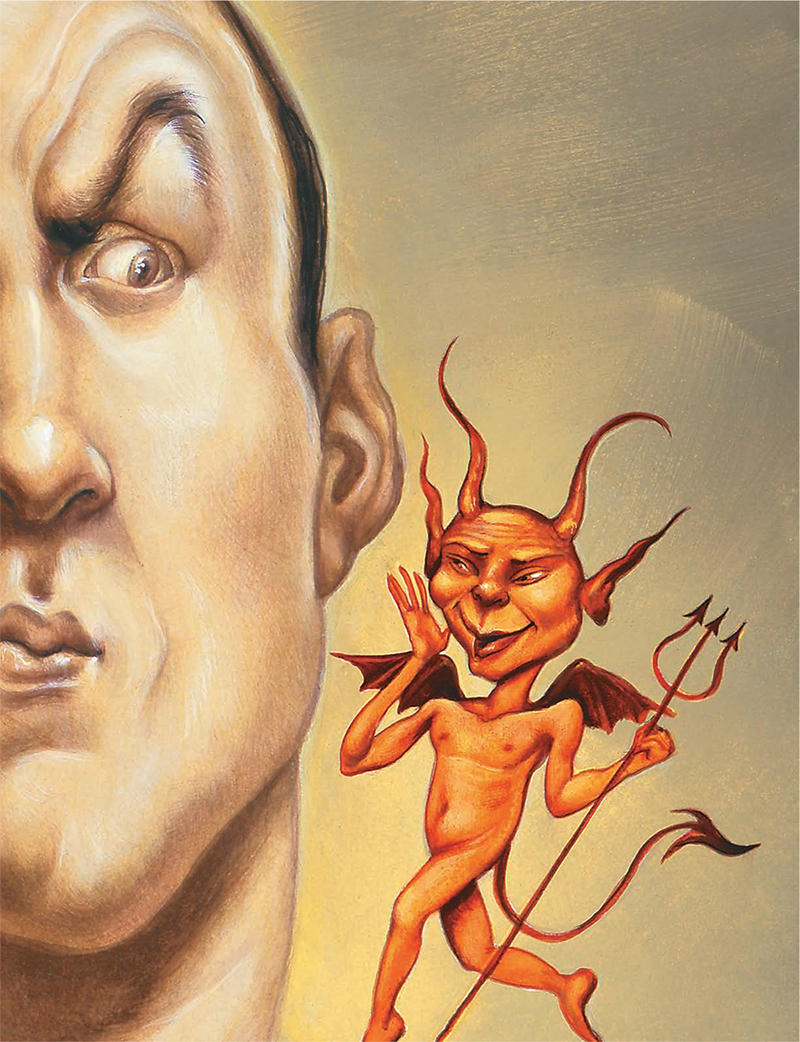

So you’ve come here. Every one of these scandals involves at least one mind, or several, making an unprincipled decision. While ethical debate often centres on the question of “what is right?” that’s not the issue in these cases. As one of the experts you’ll hear from says, “The problem isn’t the lack of understanding of what one ought to do, it’s just the failure to do it.” This mind you’re in stands on the edge of its own ethical chasm, and it’s about to make a terrible decision. Our job is to find out why.

Now, let’s understand the nature of our environment. A mind is not merely a brain. A mind is an intellect, shaped by influences. There are also emotions here, and history. The pressures of culture take up a great deal of space. And though some minds are beset by illnesses or chemical torsions that might make unethical choices more likely, this isn’t one of them. This is an ordinary mind, very much like your own.

Some of the influences on this mind are more powerful than others. Some merely provide context, a more fertile soil in which unethical motives can thrive. We’re going to concentrate our tour on the factors that are pushing this ordinary mind toward a choice it will ultimately regret, when it has a chance to think clearly. Say, in jail.

Our first stop – a large, amorphous area – is human history. This is the context I mentioned, the loam in which the mind has grown. If you were wondering whether this era we live in is the most scandal-plagued ever, look around. It’s here that we’re reminded of the wave of corruption that roared through the United States in the 1920s, and resulted in the Securities Act of 1933 and the Securities Exchange Act of 1934; the Windfall Oil and Mines scandal of the early 1960s, which led to an overhaul of Ontario securities laws; the Salad Oil scandal of 1963 (“one of the biggest swindles in history,” according to The Wall Street Journal at the time); the Wall Street shenanigans of Michael Milken and Ivan Boesky in the late 1980s; the Bre-X scandal. It’s quite a list. And let’s not forget one of the largest financial scandals in modern history – the famous South Sea Bubble – which involved not just the South Sea Company from which it gets its name, but also the government of England, almost 300 years ago.

History doesn’t tell us why this mind we’re in is going to slip its moral moorings. It merely puts to rest the notion that ethical weakness is somehow a modern phenomenon. It reminds us that our mistakes come in waves, and that to err is, sadly, inevitable.

But even if we accept that corruption has its historic place in the world, we still reject cheating as wicked. And we celebrate the example of those individuals who refuse to be lured into the unscrupulous woods. In The Naked Corporation, a recent book by Don Tapscott and David Ticoll, the authors point to BMO Financial Group CEO Tony Comper (BA 1966 St. Mike’s) as one businessman who keeps to the narrow path. “When information comes to light that might embarrass the bank,” they write, “his staff reports they’ve never heard him ask ‘How do we get out of this mess?’ Rather he poses the question ‘What’s the right thing to do here?’ This is now part of the bank’s folklore; a culture of doing the right thing has developed.”

Experts who study the ethical makeup of societies always mark off a portion of the populace who can be counted on to do no wrong. According to Professor Leonard Brooks of the Joseph L. Rotman School of Management, the forensic accountant’s rule of thumb holds that “20 per cent of people in general will not steal anything, even if they have a chance.” Those are the people we want to marry our children and handle our accounts, the ones who snarl at temptation. However, we pretty quickly run out of the Tony Compers of the world and we’re left with the fallible remainder. And this is where we start to get into trouble.

Thomas Hurka, who holds the Henry N.R. Jackman Distinguished Chair in Philosophical Studies at the University of Toronto, says, “Most people have multiple reasons for acting in accordance with moral principles. It’s complex, and the complex can unravel.” According to Hurka, when the mind that might decide to cheat chooses not to, there are two essential factors at work. The first is self-interest – a fear of punishment. “People decide not to cheat in business,” says Hurka, “because they think they won’t get away with it.” As rationales go, it might not inspire heroic string music, but it’s effective.

The second reason is subtler. “There are a lot of people who will act rightly, even at some cost to themselves,” says Hurka, “so long as they believe that other people are doing it, too.” This reasoning falls into what American social scientist Jon Elster, in his book The Cement of Society, calls “the norm of fairness.” In deciding whether or not to cheat, a person looks across the desk at her colleagues; if they’re keeping their hands out of the till, she likely will, too.

But now that we understand our mind’s typical motivations for good, we can start to see how they might break down. Let’s take fear of punishment first. In order to worry about getting caught, the mind on the brink of an unethical decision has to think getting caught is a real possibility. That requires clear and effective policing, or, as it’s called in the world of business, “governance.” According to Melissa Williams, associate professor of political science at the University of Toronto, who has a deep interest in ethical issues, the understanding that only a watchful eye keeps the populace in line informs a good deal of constitutional thought. People are morally imperfect, goes the thinking, and well-designed institutions free us from having to hope for the best from the shady characters who run them. Immanuel Kant, James Madison, Adam Smith and other philosophers, says Williams, have fashioned arguments around the premise that “a well-ordered constitutional society could govern even a nation of devils.”

In a situation like this, if governance breaks down, chaos is likely to ensue. That accountant’s rule of thumb Professor Brooks mentioned earlier puts a number to the risk: Of the populace at large, he says, “60 per cent will steal if they think there’s a good chance they won’t get caught.”

Time after time, in the case of many financial scandals (not to mention situations such as the abuse of prisoners at Abu Ghraib), it was the overseers who failed first. Hollinger’s board, for example, was allegedly compromised by, among other things, a lack of sufficiently independent directors. Says an official at the Ontario Securities Commission, who spoke on the condition of anonymity, “If you have a company with a major controlling shareholder who is the chief executive officer and all his cronies are on the board, you then have an environment where it’s more possible to have things go wrong.”

In How Companies Lie, authors A. Larry Elliott and Richard J. Schroth set much of the blame for corporate corruption at the feet of what they call “dysfunctional governance.” And they’ve discovered that bad boards have a number of common traits, among them:

1. They are mostly old business friends of the CEO intent on cranking up the company for more money.

2. They do not evaluate themselves and have no interest in how well they are meeting their obligations as trustees.

3. They prefer short, simple board sessions at nice places close by.

4. They know few of the key managers and producers in the company

If this ethically challenged mind we’re trooping around in belongs to an executive who has no fear of being fired because her board members are her friends, might it not still be scared straight by the prospect of legal retribution? Yes, indeed. But the prospect must, in fact, exist. And here again we have a problem.

At the height of the scandal fallout in the United States, we saw images of former executives at Enron and elsewhere being taken away in handcuffs, doing the so-called “perp walk” that was meant to put investors at ease. That was thanks largely to New York’s attorney general, Eliot Spitzer, who had both the power and the inclination to go after corporate criminals, and continues to do so, to the consternation of a business community that mostly resents the legal intrusion. In Canada, there are no Eliot Spitzers on the case.

Traditional law enforcement agencies have few people with the time or expertise to tackle the complexities of white collar crime. Only very recently has the RCMP set up what are called IMETs – Integrated Market Enforcement Teams – to dig into financial corruption, and they haven’t been on the job long enough to have an impact. For now, investors in Canada, where there’s no national securities regulatory agency, have to hope the Ontario Securities Commission can bring criminals to justice. Unfortunately, that’s a faint hope. “The remedies available to us,” grumbles our anonymous OSC official, “are ‘cease trade’ orders. Or we can order that [certain individuals] may no longer serve as directors or officers. Eliot Spitzer can go to mutual funds and say, ‘I don’t like what you’re doing. I’m going to take assets away from you unless you agree to a settlement.’ He can do things we don’t have the power to do. Our attorney general should be doing that!”

So here’s how a scandalous scenario develops in a mind such as ours. Once the enforcement mechanism is weakened, the segment of the population that was restrained from immoral behaviour only by the fear of “getting caught” starts to get a little frisky. Our mind, ever alert to outside influences, can’t help but notice the ethical shift. And then the “norm of fairness” breaks down.”

Once the self-interested people start to cheat,” says Professor Hurka, “that affects the people who believe in fairness, because they’re prepared to do what’s right only so long as other people are doing it. And so they start to cheat.” The norm of fairness not only allows cheating in that scenario, it encourages it. When others are cheating and getting away with it, the norm of fairness says it must be all right.

Now you can start to see how a society can experience waves of scandal, in business, in sport and elsewhere. “The existence of the motivation of fairness or reciprocity,” says Hurka, “explains why there can be these swings in moral and immoral behaviour.”

The media have a role to play here, too. In general, we have no way of knowing whether our fellow citizens are behaving ethically, but we are swayed by what we see on the news. And every time a scandal story breaks, the norm of fairness applies its effect. Even those perp walks, while increasing the fear of getting caught, reinforce the notion that everyone is cheating. “If the media concentrate on acts of wrongdoing,” says Hurka, “they will create the belief that wrongdoing is common, which will increase the amount of wrongdoing.”

This was the quandary faced by India’s four-term prime minister Jawaharlal Nehru when he was pushed to condemn corruption in his own government. In a quote remembered in Jon Elster’s The Cement of Society, Nehru complained, “Merely shouting from the house-tops that everybody is corrupt creates an atmosphere of corruption…. The man in the street says to himself: ‘well, if everybody seems corrupt, why shouldn’t I be corrupt?'”

If Conrad Black heard the reports of Tyco’s Dennis Kozlowski using $1 million of his company’s money to throw a $2-million toga party for his wife, who could blame him for looking at the $42,870 bill for a “Happy Birthday Barbara” dinner, wondering whether he should charge it to Hollinger, and thinking, “Why not?”

Before the mind decides to cheat in order to achieve something, of course, it must already have concluded that what it’s trying to achieve is important. For surely, only if profits mattered above all would someone risk everything to show dishonest numbers in an annual report. To that end, in its slow process of breaking down the barriers to unethical behaviour, the norm of fairness has a kind of ally in something you might call “cultural conditioning.”

The world of business has many tools to help executives get their priorities straight. Enron employed the “rank and yank” system of performance persuasion. At regular intervals, employees were rated on a scale from one to five, and the bottom 15 per cent were fired or pressured to leave. An atmosphere of ethical and emotional brutality prevailed. “The system was frequently used for vendettas,” writes David Callahan in The Cheating Culture. “Managers were known to lie and alter personnel records to get rid of certain employees.” Other companies use less violent means. One that’s particularly popular: the bonus. “If you have pay for performance,” says our man in the OSC, “and the CEO’s and the CFO’s bonus scheme is tied to continued earnings increases, then there are obviously natural pressures on executives to make sure that those corporate earnings are there.”

Like Olympic sprinters constantly under the strain of having to better their times, executives are expected to deliver ever higher returns for shareholders. They’re dragged forward by the carrot of bonuses and pushed by the demands of investors until they wind up headed into a moral tunnel that leaves them very little room to manoeuvre. “As the race for money and status has intensified,” says Callahan, “it has become more acceptable for individuals to act opportunistically and dishonestly to get ahead.”

If you’re wondering how things got this way, what softened up the cultural soil and allowed this ruthless age to take root, Professor Dennis O’Hara has an answer. O’Hara is a theologian at St. Michael’s College who teaches ecological and Christian ethics, and he sees in our money-mad society a rise in individualism, and a concurrent falling away of our belief in a higher power. We lost God in increments. “In the old days,” he explains, “we had what we called ‘the God of the gaps.’ Whenever there was a gap in our knowledge – that was God. As science progresses you eventually fill the gaps and then, ‘Oh, there’s no God.'”

When people convince themselves there is no higher accountability, says O’Hara, it’s easier to believe the universe is essentially meaningless. Once you reach that conclusion, the concept of the common good falls away, and it’s a short leap to deciding that the only purpose to life is one’s own personal gain and pleasure. It’s the ultimate failure of governance.

So we are down to this: a mind that has lost its sense of a higher authority and a connection to the common good – encouraged by the culture that feeds it to value money and success above all, and shown the example of others who thieve in order to achieve this success – is given an opportunity to thieve, with little fear of getting caught. It seems almost inevitable that the choice it’s about to make is not going to look good on a resumé. Nevertheless other minds on the same precipice, struggling under the same conditions, might not plunge into the darkness. What pushes our mind over the edge?

Come this way, to the situational ethics zone. Here is our mind locked in the moment, looking at its options. It isn’t measuring them against a clear ethical yardstick that defines what’s bad or good – we know it lost that a long time ago. Instead, it’s trying to assess this particular decision according to what’s acceptable under the circumstances. And because that’s not easy, it’s using a few tricks.

Rationalization is one. Joseph Wells, a former FBI agent, told David Callahan that a hallmark of high-level fraud is “the ability to call the fraud by a nice name.” Faced with a grim financial reality, a chief accountant reinterprets the acceptable rules. He rethinks the recipe for success, stir-fries a few of the raw numbers and cooks up something “for the good of everybody who works in the company.”

He may not even think of it as cheating. That’s trick number two: self-delusion. “I think people can convince themselves of almost anything,” says O’Hara. “When I listen to certain corporate leaders, I hear their positions, I hear their arguments, and I find them absolutely contemptible. And yet, do I think that they really believe what they’re saying? The answer is yes. I think that they’re convinced of their own goodness.”

One of the chief attractions of religion is its ability to make the complex clear, to provide ready answers to difficult questions and to hold out a promised land as reward for going along. O’Hara understands the need for the guidance of dogma, for the relief from having to “start from square one” in the face of every ethical dilemma. But he says, “We’ve fallen in recent times into this notion that there has to be a single right answer. It’s as if we want a catechism and everything’s going to fit into this catechism.” For corporate executives, the catechism has to do with the bottom line – what’s right for the shareholders is, de facto, right. And profit has become the new afterlife.

Hugh Gunz, a professor at the Rotman School of Management who studies organizational influences on ethical decision-making, has looked at what effect rank has on the situational ethics of executives. The research he and his colleagues have done suggests that an individual’s willingness to cheat is influenced by how close he thinks he is to the company’s centre of power. “The more you feel yourself to be at the centre of things, to be a member of the top management team, the more you’re likely to take an organizational, managerial answer,” says Gunz. “To say, in other words, ‘Let’s do something for the good of the company, rather than what might be professionally correct.'”

John C. Maxwell, in his book There’s No Such Thing as Business Ethics, decries the rise of situational ethics in which there is no longer any absolute good, only shades of what’s-good-for-me? He quotes from the description of a University of Michigan course entitled Ethics of Corporate Management: “This module is not concerned with the personal moral issues of honesty and truthfulness. It is assumed that the students at this university have already formed their own standards on these issues.” It may be that the university was simply admitting the impossibility of teaching values to its students, but Maxwell considers it proof that, where once our decisions were based on ethics, now our ethics are based on our decisions.

That dim assessment may actually have some foundation in fact, though not in the way Maxwell believes. We’re almost at the end of our tour, and you may have noticed there’s one thing we haven’t looked at yet – the mechanics of the mind. Since we can’t ignore the fact that the mind operates within a biological organ, we have to consider how its inner workings might influence the decision-making process. Is there anything about a well-functioning set of synapses that might contribute to a regrettable decision?

Apparently, yes. And again, its roots lie in the mind’s relentless desire to find the easy path to clarity in the midst of chaos. Donald Stuss, a professor of psychology and medicine at U of T, and director of the Rotman Research Institute at the Baycrest Centre for Geriatric Care, has looked at the functioning of the frontal lobes of the brain, where decisions are made. The research he and others have done suggests that as we go through life, we create models of behaviour. “That’s what the brain does,” Stuss says, “to simplify the world.” If we try something once, and the outcome is good, we’re likely to do that again. The more we do it, the less we think about it; the more the pattern is established, the less work the brain has to do.

Someone might hesitate, even agonize, the first time she crosses an ethical line. But if she isn’t caught, and no one gets hurt, she does it again, and again, until it becomes a pattern of acceptable behaviour. “If our model of the brain is correct,” says Stuss, “it could explain why people often don’t feel guilty.” In September of 1980, Brian Molony, a highly regarded CIBC bank employee with a gambling problem, made what he was sure was a one-time decision. He faked a loan in order to cover a $22,300 gambling debt, with every intention of paying the money back and erasing the fraud. According to the book Stung, by Gary Stephen Ross, by the time he was arrested, a year and a half later, Molony had committed fraud 93 times to a total of more than $10 million, and he was still convinced he needed just one good run at the casino to get back to even. “Most people who do something unethical,” says Stuss, “get to the point where the thing is explained away.”

These patterns can be established early, well before a CEO is fudging numbers and putting investors’ money at risk. In The Cheating Culture, Callahan devotes a chapter to dishonest students and reports the results of a 2001 study of 1,000 business students on six campuses. It concluded that “students who engaged in dishonest behaviour in their college classes were more likely to engage in dishonest behaviour on the job.”

It makes sense to us, intuitively, that people who have cheated before will cheat again. But we make a mistake if we dismiss the cheater as merely a bad apple. Barbara Ley Toffler knows it isn’t true. She was there, at the accounting firm Arthur Andersen, when its leaders made the decisions that linked the firm inextricably to the Enron scandal and ultimately brought it down. She went into that company with high ethical standards, and was appalled at some of the practices she witnessed. But under the influence of the corporate culture, the norm of fairness and the rest of the factors we’ve looked at, it wasn’t long before her standards changed. “I didn’t break any laws or violate regulations,” she writes in Final Accounting, “but I certainly compromised many of my values…. If you hang around a place long enough, you inevitably start to act like most of the people around you.” Toffler now conducts orientation sessions on ethics with MBA students, and one of those students told her something she wants us to hear: “I believe anyone has the potential to be a bad apple.” The mind we’ve been looking at has no evil intent; it thinks of itself, its motivations, as good. And the terrible choice it’s about to make? It might just seem the best decision of all.

Trevor Cole was recently nominated for a Governor General’s Literary Award for his novel Norman Bray in the Performance of His Life.

Recent Posts

For Greener Buildings, We Need to Rethink How We Construct Them

To meet its pledge to be carbon neutral by 2050, Canada needs to cut emissions from the construction industry. Architecture prof Kelly Doran has ideas

U of T’s 197th Birthday Quiz

Test your knowledge of all things U of T in honour of the university’s 197th anniversary on March 15!

Are Cold Plunges Good for You?

Research suggests they are, in three ways

8 Responses to “ Why Good People Do Bad Things ”

Trevor Cole examines why people make unethical business decisions, but doesn't consider the planning horizon. An executive who is preoccupied with how his decisions affect the short-term stock price of his company is more likely to do what is expedient - or, as Cole puts it, resort to situational ethics.

Executives concerned with their company's long-term performance are more likely to make decisions that reflect ethical values. After all, unethical choices made in the hope of short-term gains are likely to become apparent over the longer term.

Bill Kennedy

BCom 1981 Trinity

Toronto

Trevor Cole's article, though generally insightful, treads lightly over some significant terrain. I would like to have read more about the influence of family and spirituality on ethical behaviour. North America is a society of overachievers. From birth, we are told that for every winner there must be one or more losers. It's no wonder that this obsessive focus on success invites ethical shortcuts.

Whether they like it or not, faculty members should act as role models for students. Similarly, churches, synagogues and other spiritual organizations can provide guidance and help restore the balance between the material and the spiritual aspects of our lives.

Don Mulcahy

DDS 1967

Edmonton

Thomas Hurka, who holds the Henry N. R. Jackman distinguished chair in philosophical studies, offers two main reasons for why people behave ethically: self-interest (a fear of punishment if they're caught behaving badly); and the knowledge that other people are behaving ethically. Is this correct? Are there no Kantians left? Don't most people who behave ethically do so out of a sense of moral duty to do the right thing?

Mark Bernstein

BSc 1972 University College, MHSc 2003

Toronto

Trevor Cole's article is timely and informative. His research into the "why" of unethical behaviour went far beyond the sensational approach of the news media, and it was gratifying to read about the Rotman School's plan to focus on good corporate citizenship.

Patricia Rudan

BA 1983 Erindale

Mississauga, Ontario

Congratulations on an excellent article about corporate governance. We should use the recent bout of business philandering to teach the next generation about the perils of selfishness, materialism, and believing oneself to be above the rules, and that one's humanity - not a garage full of rolls royces - is the true measure of a person's worth.

Laura Pontoriero

BA 2002 University College

Toronto

As long as capitalism allows small numbers of wealthy, powerful people to control the main institutions of our economy, corporate greed and financial scandals are inevitable.

Socialist democracy, where working people and citizens democratically own, control and manage large sectors of an economy on a not-for-profit basis, would do far more to create good financial governance than any state regulation or "corporate responsibility" clauses written by management school professors.

When our economy is driven primarily by the profit motives of private corporations, we're just asking for trouble.

Sean Cain

BA 1998 UTM

Oakville, Ontario

Sean Cain proposes a socialist democracy as the key to good financial governance. Cain is mistaken, however, if he believes that not-for-profit organizations are exempt from greed and corruption.

No system of social or corporate governance is perfect. However, if the world were to abolish the commendable goal of creating value (wealth through profits, which in turn generate tax receipts), the entire planet would enter a catastrophic downward spiral.

Richard M. Clarke

BASc 1954

Westport, Connecticut

Trevor Cole asks whether we are living in an unethical era.

Dean Roger Martin could make the Joseph L. Rotman School of Management the best business school in the world by putting this question at the centre of the school's mandate.

In November 2003 the Ontario Securities Commission launched an investigation into allegations of "market timing" irregularities in Canada's mutual funds industry. Perhaps Professor Martin should invite Michael Lee-Chin, the CEO of AIC Ltd., a major mutual fund company, to join the Rotman faculty. They could jointly offer a course on the ethics of our era. Mr. Lee-Chin could discuss the real world of mutual fund investing and why his company, while acting legally, could nevertheless agree with an Ontario Securities Commission requirement to make restitution of $59 million to clients of his firm.

Difficult issues, real people, real debate: really good business school.

Walter Ross

BA 1964 TRIN

Toronto